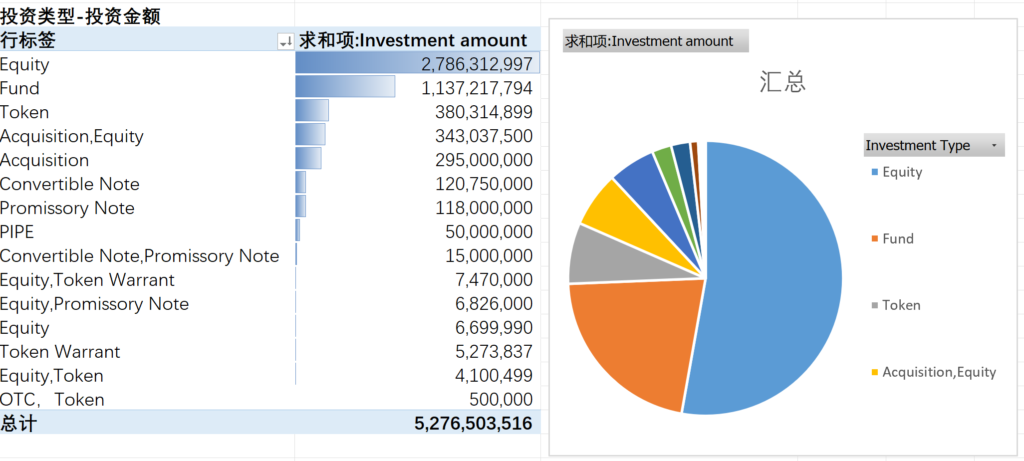

The crypto exchange of Sam Bankman-Fried, which has now become bankrupt, has disclosed its Alameda investment portfolios. The portfolios show a distinct bundle comprising up to five hundred illiquid investments that are split across ten holding firms. The cumulative value of the investment mentioned on the spreadsheet is more than $5.4B, according to FTX. Yesterday, Silvergate Bank confirmed adequate liquidity after FTX debacle.

FTX’s Alameda Investment Portfolios Show Contrasting Five Hundred Illiquid Investments

One of the two biggest investments in the respective statistics takes into account the $1.15 billion invested in Genesis Digital. The other one shows $500 million invested in Anthropic (established by the employees of OpenAI). Apart from that, as per “@FinanceYF3,” the crypto company had additionally invested up to $900 million in Sequoia K5 Modulo. That’s not all, $50 million amount was invested in each of Near, Polygon, and BAYC while Aptos got an investment of $75 million and Sui got $100 million.

The crypto news reporter Wu Blockchain remarked on these records by saying that because of having a considerable investment, Sequoia is advocating for the now-beleaguered exchange of Sam Bankman-Fried (SBF). It additionally disclosed that the crypto exchange also invested in a couple of blockchain media firms based in China named Blockbeats and Odaily. The former had up to 30% shares of the company while the latter had nearly 25% of the shares. It will be interesting to know the reply of FTX because previously he negated all allegations of fraud.

The Revealed Records Can Assist Regulators to Delve into the FTX Bankruptcy

The portfolio can play a vital role in the procedure of recoveries from the bankruptcy of the crypto exchange. The regulators might also check information to determine if the exchange was ever functionally separate as was claimed. In one of his interviews, Bankman-Fried accepted that he had some involvement in the venture capital operations of Alameda Research.

**Trending Now: **Coinbase CEO Asserts SBF’s ‘Accounting Error’ for $8B Does Not Justify against Scrutiny

Nonetheless, the FTX founder has been escaping the questions being asked over the mismanagement of the funds of the FTX users up till now. Keeping in view that spreadsheet, demarcations between the firms of Bankman-Fried were not clear.

A couple of the largest holdings of Alameda, including Genesis (a crypto miner) and Anthropic (an artificial intelligence research team), also have an involvement. They are also mentioned on FTX’s draft balance sheet issued in November. It was subsequently reported that, after the margin call, the crypto exchange halted some assets from its sister firm Alameda.

Comments