Ponzi Schemes

A Ponzi scheme is an investment fraud where a perpetrator pays existing investors with funds from new investors.

Instead of collecting funds from legitimate investment profits, a Ponzi scheme perpetrator pays returns on investments via capitals deposited from new investors. Thus, the perpetrator promises to invest this money and to generate high returns. However, he will not invest as he promised, but will use for other fraudulent purposes.

A Little Background Story

Charles Ponzi, an Italian swindler, is the alleged creator of the Ponzi scheme. In the early 20th century, Mr. Ponzi convinced investors that he can make a 40 to 50% return on their investment in IPRCs (International Postal Reply Coupons) within three months. Of course, early investors did receive their payouts since Mr. Ponzi was using the funds of later investors to keep his scam snowballing. But, he got away with the scam as the number of people investing in IPRCs was growing. Eventually, the scheme collapsed while the majority of investors got their money stolen with no returns. Charles Ponzi was able to steal millions of dollars through tricking people and using their money for fraud. And that’s how this type of scheme was attributed to Charles Ponzi.

How Does it Work?

An early investor falls into the trap, believing that he’ll receive huge payouts on the short term. Thus, he invests a large amount of money in whatever type of investment the operator is offering. It can be an investment in natural resources, real estate, and even in crypto. These early investors receive their payouts as promised which gives the perpetrator credibility. And therefore, more people will start to invest. This success story buy the operator more time to grow his network of investors. How does it always end? People catch on and then the scheme collapses.

Why does the crypto world attract a lot of scammers?

The boom of cryptocurrencies in global markets does attract scammers to trick investors into investing in Ponzi schemes. This use of virtual currencies rather than conventional currencies facilitates fraudulent scams, and fake transactions and investments. The scammers could create an unregistered trading platform where they promise high returns in short periods. So why crypto space is a great cluster of frauds? Simply, virtual-currency transactions are more private and less regulated by governments than conventional-currency transactions.

Why do some people consider crypto itself to be a Ponzi scheme?

Some people argue that cryptocurrencies such as Bitcoin are a Ponzi scheme. Mainly because their value is virtual and not linked to anything other than the market. Another argument is that holders cannot use Bitcoin unless liquidated into fiat money. These aspects make cryptocurrencies very similar to a Ponzi scheme: they seem grow on hype as a never ending stream of new investors is coming into the crypto sphere every day.

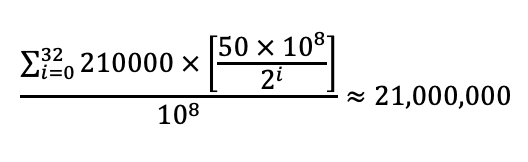

Although these arguments might seem right and logical at first glance, investing in crypto is much more complicated than that. First, you should remember the massive cost and amount of energy invested in the hardware that mines reliable cryptocurrencies like Bitcoin. This factor gives this “virtual” money a lot of credibility and physical value which proves that they are actual worthy and reliable projects.

In a Ponzi scheme, victims are unaware about how the investment works and how it’s being done. On the other hand, transitions and investments in crypto are transparent and always recorded on a blockchain. Let’s also not forget that this transparency is also clear since current market prices are always available.

Reliable cryptocurrencies do not offer any promises. When investing in them, investors know how volatile and unstable these assets are.

But how can you detect a Ponzi scheme in the crypto world?

When the only selling point of a cryptocurrency is the number of people investing in it, then it’s most probably a Ponzi scheme. In this case, you can imagine how it will collapse with nothing to hold it on the smallest pitfall . Here’s an example of what a Ponzi scheme could look like:

In May 2022, Eddy Alexandre, a New Yorker, got arrested for running a cryptocurrency and foreign exchange trading Ponzi scheme. In total, he collected $59 million. He ran a crypto and foreign exchange trading platform –EminiFX- to fund his own luxurious lifestyle from investors'' money.

Here are 3 signs to look out for in a crypto Ponzi schemes

1. Promised returns that aren’t logical

Every time an opportunity guarantees easy and very fast moneymaking, it is most likely to be a scam. Bernie Madoff, a modern day Charles Ponzi, is responsible for one of the largest Wall Street Ponzi schemes. He promised an annual return of 12%, This should’ve been an alarming sign for investors because market returns are unpredictable.

Ponzi schemes exaggerate the returns on investments. In Eddy Alexander’s scheme, EminiFX promised investors that it’ll guarantee returns of nothing less than 5% each week. Does that seem plausible?

2. Promoters use very flashy ways to display their wealth

Con artists and swindlers try to entice the investors by showing them what all of this money can get them: a very lavish life. They would usually throw a lot of parties and conferences and any other event that helps them display this "shaky" wealth. If someone needs to highlight their net worth, they aren’t worth what they’re trying to prove.

3. Not getting any disclosure about the technicalities

Being very secretive and non-transparent about the source of returns is a big red flag. EminiFX for instance told its investors that their returns come from automated investment in cryptocurrency and foreign exchange trading. However, they never gave an explanation about how they actually did it. It was a “trade secret”.

![Is DeFI legal? [Dec. 2022]](/uploads/2022/05/1440x720px_WhtsDefi-390x260.jpg)

Comments