Shitcoins: How to Successfully Identify Them?

As its name obviously indicates, a Shitcoin is a valueless type of cryptocurrency. In fact, the term “Shitcoin” covers all types of cryptocurrencies that have failed, are failing, or that classify as spin-offs. Therefore it is imperative to identify and avoid the shitcoins.

Usually, Shitcoins do not have any specific purpose since their existence is not based on any of the important crypto supports. The only support a Shitcoin has, is the fact that it exists, and nothing else. In other words, Shitcoins lack fundamental factors that must be present when identifying a cryptocurrency that is credible and that has growth potential and longevity.

One example of a cryptocurrency spin-off is Dogecoin. In 2013, Dogecoin was branched from Litecoin and gained very fast popularity as it adopted a meme-like identity. It adopted the famous Shina Inu dog breed as its logo and it was commercialized as a funny currency. Elon Musk is one of Dogecoin’s biggest supporters which is its main source of value. Without Musk’s tweets, support and initiative to accept payments in Dogecoin for Tesla, Dogecoin would crash and become truly valueless.

Dogecoin is a one-of-a-kind Shitcoin that has an impressive success story. But it’s still very risky to invest in because it could suddenly crash once it loses its only support.

How does a legitimate cryptocurrency gain value?

Any legitimate cryptocurrency can undergo fluctuations and changes in its value depending on its supply-demand balance. However, this is how users can add value to a certain legitimate cryptocurrency and how we recommend you DYOR to avoid shitcoins:

1. By buying low and selling high: this is a classic investment strategy where the more people buy something, the more expensive it becomes because it’s in high demand. As a result, the value of the coin increases.

- By mining: Mining impacts the supply of any cryptocurrency on the long run. People who mine cryptocurrencies can earn newly minted coins as a reward. This factor also increases a coin’s value.

3. Through increasing utilities: the more legitimate businesses and institutions invest in a coin, the more it gains credibility. And when they accept it as a form of payment, it starts having more utilities, and therefore, it becomes more useful.

4. Through media coverage: the more a cryptocurrency gains media attention, the more it gains visibility, credibility and therefore, more value. This factor also influences the number of people investing in it which also affects its price.

Shitcoin traps: mass purchasing and value speculation

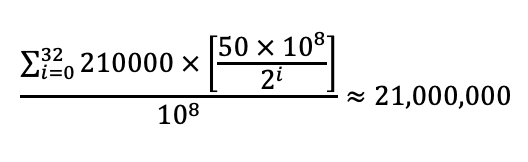

Typically, developers must specify the number of tokens made available for trading and purchasing. Bitcoin for example offers 21-million-coin limit in its market, and Ether caps its supply at 18-million-coin limit per year. So, the scarcity of these coins is an essential tool that gives them value because investors now know that there is a limited number of coins to buy. After specifying the supply, the value of the coin is then subject to the market’s demand.

Oppositely, Shitcoins attract a huge influx of investors who pump in their money to invest in this coin once it launches. So for a brief period, the coin’s market value jumps to a high. But once they’ve made their short-term gains, investors start to cash out and the coin’s value crashes. This makes it extremely feasible at identifying shitcoins.

A Shitcoin is also different than a legitimate cryptocurrency because it has unclear and non-specified utilities. As a consequence, its value is only based on speculation. This speculative pricing makes it extremely difficult to predict a crash. For this reason we recommend you avoid shitcoins all-together.

Most cryptocurrencies have limited and unclear practical usages. They have a very restricted value when it comes to using them in real-world situations especially since services using cryptocurrencies in the real world are still very limited. So if you do not have a clear image of what investing in this coin offers you, it’s a Shitcoin and avoiding it should be a priority.

In a nutshell, Shitcoins usually have their value based on speculation and mass purchasing.

What are other indicators that help you with identifying a Shitcoin?

There are many red flags that scamming developers might try to cover when it comes to hiding the “symptoms” of a Shitcoin. However, always keep an eye out for the following red flags:

1. The developers are shady and mysterious

Reliable cryptocurrency developers are usually visible to the public eye. They want to establish a reputation for the project that they are working on. Developers who stay behind the curtains without any kind of visibility are very suspicious and are most probably scammers. If they are also very flashy and never give out accurate explanations about how they want to develop their crypto projects, they are also on the scammers list.

2. The functionalities are undefined

As mentioned before, Shitcoins do not identify their purposes. They only exist without having any clear utility to offer. Blockchains like Bitcoin and Ethereum are actual stores of value because of the utilities they clearly offer. They improve and facilitate decentralized finance through enhancing transaction security and removing central authorities. A clear roadmap that visualizes the process of getting to those objectives and utilities is necessary.

3. The project is generic

If the project is hosted on a free domain, its website has a lot of typos, and the design seems very generic: it’s an obvious red flag. This is a sign of lack of authenticity and professionalism. If the white paper is also written with terms and structures that are too technical to understand and very inaccessible for the reader, it is also a major red flag.

4. Very few holders

Typically, a legitimate cryptocurrency has around 200 to 300 coin owners. Any number below this threshold is a bad sign. It is also important to note that any new and worthy coin has between 5 and 10 transactions per minute.

5. A dry liquidity pool

Decentralized exchange platforms rely heavily on their liquidity pool. A platform that displays less than $30,000 in its liquidity pool is most likely offering you a Shitcoin. If the coin also exhibits for big discounts that can go up to 30%, it is an unsustainable offer, and therefore a scam.

![Is DeFI legal? [Dec. 2022]](/uploads/2022/05/1440x720px_WhtsDefi-390x260.jpg)

Comments