All Token Use Cases You Didn't Know About

A token? Isn't it just a coin? Another complicated crypto jargon... These two words seem interchangeable when we talk about cryptocurrencies. However, they have two distinct meanings. So, let us settle the matter straight! In this article, we will explain the correct terminology to use: what is a token? And what are their use-cases?

Definitions: let's clear it up!

In our world, tokens serve as a mean to buy goods or engage in activities. In exchange for your money, you can get a token that would allow you to take the Ferris wheel in an amusement park or even buy popcorn. Later, it became by consensus a proof of membership or ownership. Recently, the term “token” has gained a new meaning in the wake of the crypto evolution. As simple as it is, a token is just a less fancy word to say “cryptocurrency” or “crypto-assets.” However, most people mix up “token” and “coin.” There is a fine line separating both terms, but it is definitely not rocket science.

Tokens vs Coins

A token is a digital representation of an asset that can be exchanged using the blockchain network. It could represent something in a particular ecosystem: whether it is something concrete ($5) or abstract (a vote). Contrary to a coin, it is a cryptocurrency that does not have its own blockchain but is built on top of other protocols (blockchains). Some blockchain platforms like Ethereum allow people to build decentralized applications on top of it. Usually, these decentralized applications issue their cryptocurrency called a token. A prominent example would be Maker.

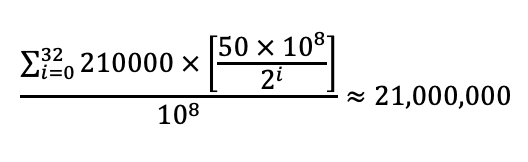

On the other hand, coins function as a store or exchange of value. For example, Bitcoin is a coin, not a token. You can store your Bitcoin and hold it almost like a bank account. Then, you can use it as a medium of exchange. In addition, a cryptocurrency coin runs on its own blockchain. Some cryptocurrencies coins are variations of the Bitcoin blockchain, while others are unique. Nevertheless, they are all self-sufficient. These currencies facilitate payments as it is the people who decide what they are worth.

## What are the distinct types of tokens?

## What are the distinct types of tokens?

Each token serves a specific purpose. However, they could fall under several types. Here is a list of the most common ones:

Governance Tokens:

As its name suggests, governance tokens give you governance rights in a certain protocol in DAO or DeFi. These protocols issue these tokens to sell or give it out as part of a reward.

Governance tokens oppose the practices of traditional centralized organizations. Instead of limiting the power to a single leader, they provide its holder the right to participate in managing the company. For that reason, holders can set rules and regulations, and influence the future of the protocol.

However, the organization of governance and implementation may vary depending on the project. A general practice is one where the project mints and sells an initial supply of these governance tokens.

Once they have bought them, holders are part of what we call “decentralized autonomous organization” or “DAO” (For more information about how DAO works, click here.). As an example, we cite Uniswap (UNI) or Compound (COMP). These decisions could involve, for instance, creating new services or products, allocating a budget, setting up an upgrade, etc.

Security Tokens:

Security tokens represent tradeable financial assets. Thus, they are an investment as they pay dividends, share profits, or interest. To put it in simple words, they are a promise of profit. Security tokens are considered securities by financial regulators. As a result, they abide by the same regulations as traditional stocks and bonds. They provide legal safeguards and regulatory clarity.

A security token signifies ownership, most commonly a stake in the company that created the token. It works exactly as buying stock on a traditional stock exchange. This is why, they are often referred to as equity tokens.

To identify which token is a “security,” The Howey Test states:

A transaction is considered a security sale if a person invests his money in a common enterprise and is led to expect profits solely from the efforts of the promoter or a third party.

In another sense, it should meet the following criteria: 1- The existence of an investment 2- The formation of a common enterprise 3- A promise of profit 4- A third party promoting the offering

Utility Tokens

A utility token is a promise of future use of a product or service. It is a cryptocurrency that has a “utility” within a certain blockchain ecosystem, to access a service or a product. In other words, it is a representation of a certain value that is used in blockchain. Look it at as a medium of exchange through which the consumer pays the provider of a service. So simply, they are solely promotional tools while they do not grant you any stake in the company.

For example, in a decentralized exchange (DEX), users need to pay with “exchange tokens” to complete the swap. These tokens can pay the depositors who provided liquidity to the platform or reward users, for example, BNBs in Binance Smart Chain. Another example of utility tokens is BAT which is a tool for advertisement in the Brave browser. It is also a way to reward content creators on their website or Twitter.

Pegged Tokens

A pegged cryptocurrency or a “stablecoin” is a mean of exchange whose value is tied to another mean of exchange that has a market price. That means, the value of the cryptocurrency varies according to the currency or the asset to which it is pegged.

Pegging a cryptocurrency to a relatively stable asset of value can protect the said currency from the fluctuation of prices and prevent a total loss of funds. Sometimes, these fluctuations are not so innocent. For their own benefit, whales, who hold a large sum of a specific cryptocurrency, can manipulate the balance of supply and demand. They sell them at a high price to re-buy when tokens have hit low levels.

The most popular pegged cryptocurrencies are the ones collateralized to the United States Dollar. As an example, USDC maintains the same value of $1. In addition, they can also be collateralized by other types of assets, for instance, gold like PAXG.

A Tokenized World

Tokens have many use cases that haven’t been explored. While it is changing the way we organize ourselves as a society, the token industry is in its early stages. To mature, tokens need to address issues such as customer accessibility and regulations. Once they are on track, the public will learn to trust them as a way of payment and ownership.

Our economy is taking a more democratic shift where everyone can buy assets or a fraction of them. Thus, tokenizing our world is the next logical step to take.

![Is DeFI legal? [Dec. 2022]](/uploads/2022/05/1440x720px_WhtsDefi-390x260.jpg)

Comments