There is an exorbitant amount of people who claim to be professional crypto traders. All of them use certain tools or software to enhance their experience, and further their knowledge. Most of the time, when analyzing a blockchain market, traders utilize different points of data. Furthermore, this data heavily relies on two or three different core pillars. Essentially, there are many different charts to analyze and look at, the NUPL chart (Net Unrealized Profit Loss), is among the most famous of them. However, most of them use market capitalization as a way to calculate these figures. Essentially, NUPL is based on the Market Cap and the Realized Cap as per lookintobitcoin.

What is Market Cap?

Earlier we discussed how market capitalization is used in trading and for data analysis. But the question still stands, what is market capitalization? Market cap essentially attempts to estimate how much money stands behind a project on paper. To explain it in a simpler fashion, the market cap is how much money everyone has collectively.

The issue with market cap is the calculation does not factor in cashing out. Therefore, the equation is intended for a general overview of how much money is shown in everyone's wallet. Thus the formula is precise, yet not a completely accurate overview of how much money is invested.

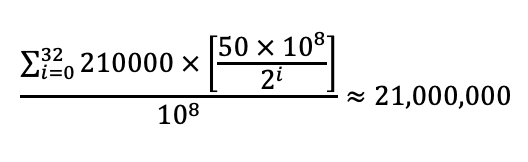

How is it calculated?

So now we have disclosed that Market Capitalization does not actually mean how much money is behind a project, but rather, what the value of this money would be at this price. Market capitalization is calculated by multiplying the total "circulating" supply by the price. Circulating supply simply is the number of tokens or crypto available on the market. Therefore burned, or staked crypto should not be considered circulating.

The market cap of the project changes based on the money inflow, HODL capacity, and money outflow. Therefore as more money flows in, the market cap grows exponentially, and as money flows out it shrinks drastically. Thus, with a few dollars, you can create a token with trillions of dollars in market cap.

What is realized market cap?

The realized market cap depends on how much money was invested into a project and is also an extremely useful figure when looking at a cryptocurrency's price. Cryptocurrency's price is set on speculation, as such, it is imperative to get a general overview of how many people are in profit, and how many people are in loss. The realized market cap helps to achieve exactly this. It is a formula that essentially attempts to improve the market cap formula by factoring in all lost (or burnt) tokens. This gives further insight into the cryptocurrency in question.

How is it calculated?

Realized market cap is a metric that can be calculated similarly to market cap, the main difference is at what price the asset is calculated. For realized market cap, rather than using the current price of the token or cryptocurrency, the price taken is the last time it moved. Therefore, the realized market cap is a more reliable metric than the regular market cap.

In conclusion, crypto traders use numerous tools and bits of data to enhance their prediction on the price, we believe that the equations for the regular market cap reflect a good emotional representation of the future movement, whereas the realized market cap represents a more realistic figure as to how much money is behind a project. Essentially we believe the more data a crypto trader has, the more accurate his prediction can be. It is always important to DYOR particularly when it comes to crypto trading.

Don't forget to drop a comment if you feel something is wrong or would like to add some information. Follow our socials for tips and information about the crypto markets. Always DYOR and Resh out!

![Is DeFI legal? [Dec. 2022]](/uploads/2022/05/1440x720px_WhtsDefi-390x260.jpg)

Comments